Banks and financial services have long customer lifecycles but engagement is sporadic, transactional, and unsustained. Our end-to-end loyalty solutions are designed to help engage with customers throughout their journey, addressing preferences and overcoming challenges like high churn and dormancy along the way. What you get are enriched relationships where you understand customers better and customers contribute to your growth.

From cards to accounts, mobile/net banking to loans, create unified customer experiences across business verticals with an Enterprise-Wide Loyalty Program. Personalise customer views on the platform based on segments and/or tiers and display relevant communication, offers, rewards and more to enable 360-degree engagement.

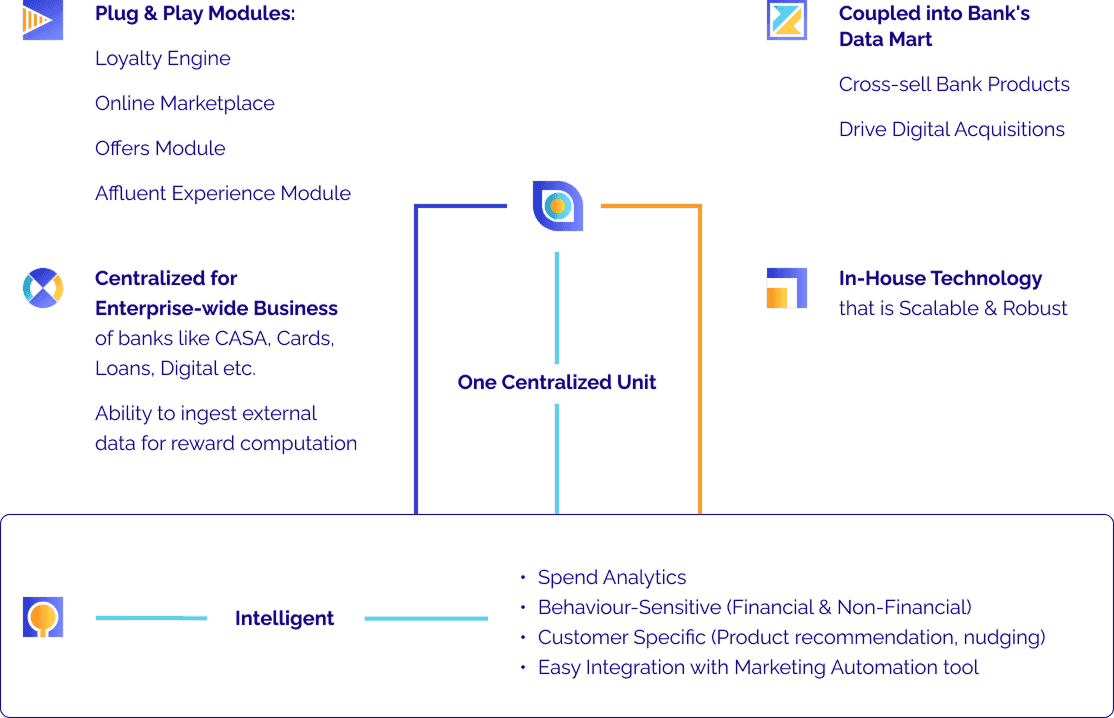

One platform, multiple capabilities

One benefit-driven features

deliver, the differentiation you need

- Award points as per customer value with tier-wise accrual

- Reward customers across touchpoints with multi-channel accrual

- Prevent program exploitation with point capping and fraud detection

- Increase engagement with transactional and non- transactional accrual triggers

- Drive business objectives through customized point value

- Improved customer experience with segment-wise UI/UX

- Ease of redemption with online and offline options

- Seamless integration with Single Sign-On

- Reduced checkout TAT with single-swipe redemption

- Wide range of rewards with a suite of over 40K merchandise

- Increase program adoption with predictive analytics

- Grow customer reach with targeted communication

- Analyse customer behaviour with intelligent insights

- Offer assistance 24x7 with customer support and a chatbot

- Enhance online interactions with user-friendly websites in language of choice

Customize your program to your industry goals

Gain competitive advantage

with personalised rewards, a flexible program structure and differentiated offerings for your customers.

Cross-sell and upsell

products and services with an enterprise-wide loyalty program that rewards customers however they engage with you.

Increase customer stickiness

with targeted and timely communication, tactical offers, and relevant rewards that keep customers coming back for more.

Drive customer value

by incentivizing customers for the right actions and transactions, thereby driving incremental revenue for your business.

Increase the customer spend

on your banking channels with merchant-funded offers.

Delight customers

with real-time rewards and tier upgrades when they complete both actions and transactions.

Gamify

transactions and desired behaviour with customised interactions that make earning rewards fun.

Get complete control

over gratification with cost- control measures and our expert advice.

Multi-dimensional behavioural incentivization,

360-degree customer engagement

What you get when we design your

engagement program

Explore our products and services

Make banking with you and for you rewarding

with our engagement solutions